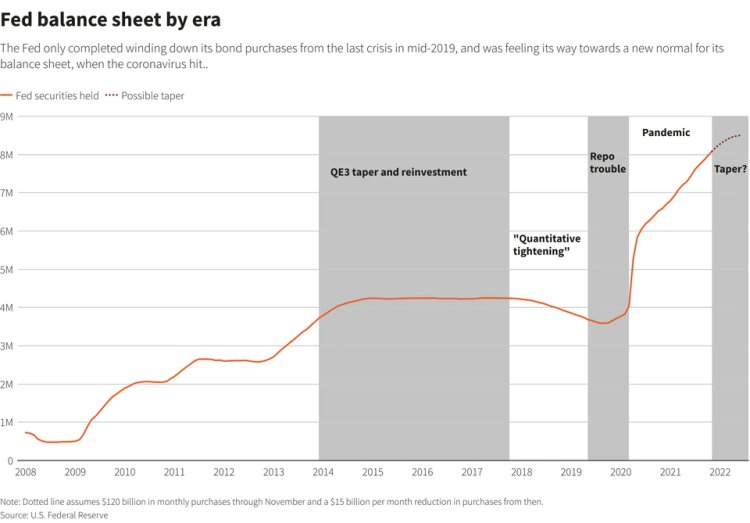

Is the FED balance sheet the single most effective indicator of all? Let's find out in this article...

The debate is growing between financial and investing experts, some says that the FED balance is the single most important indicator for the stock market performance.

Some say FED balance is a 100% effective indicator of how the stock market will do and some say that there's no direct correlation between them ¿Whats the real truth?

Lets find out...

Once you dive deep into the central banking and moneary system is natural and logic to think that a mayor massive inflow of money into the system will absolutely freate more inflation and higher prices for the stock market.

But how exactly does the fed goes throughout this process of "creating money" and injecting liquidity into the economy? We'll discuss it later on this article

Some experts state that a higher balance sheet on the FED will indicate 100% acurrately a rising stock market, because the belief implies that mor emoney in the market will rise all finanial assets including bonds, stocks, real estate, etc.

On the other hand, long term investors and also researchers state that there is no absolute indicator for a rising or declining stock market and the correlation between the FED's balance sheet and the stock market is far from accurate in predicing higher or lower prices of stocks.